By Alex Camardelle, Ph.D.

Frankly, a one-time $1,000 “MAGA” account for newborns sounds like a nice gesture – but will it help Black families build wealth? In the House GOP’s 2025 tax bill, lawmakers proposed creating “Money Accounts for Growth and Advancement” (MAGA accounts) for every U.S. citizen child born from 2025 through 2028. Every qualifying baby would get a $1,000 starter investment, seemingly to jump-start their future. The pitch is patriotic and optimistic, yet many experts and community advocates are skeptical.

What Exactly Are “MAGA” Accounts? (And Who Benefits)

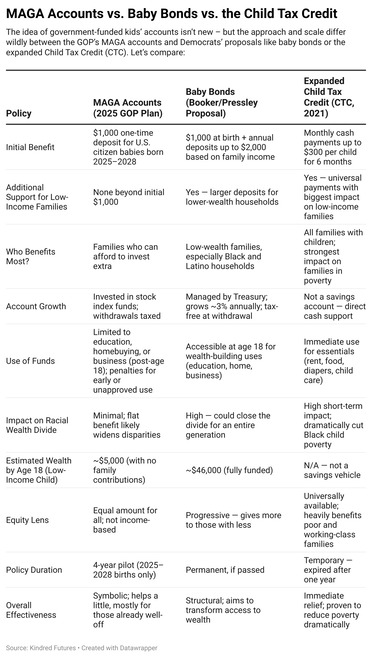

The tax bill’s MAGA accounts plan is essentially a government-seeded investment account for kids. Here’s the rundown: If you have a baby in the U.S. between Jan. 1, 2025, and Dec. 31, 2028, the government will deposit $1,000 of taxpayer money into an investment account for that child. Families can then contribute up to $5,000 each year per child (indexed to inflation) into this account. The funds must be invested in a low-fee index fund tracking U.S. stocks – so essentially, your child gets an 18-year ride on the stock market. The money is locked up until the child turns 18 (no withdrawals before adulthood), after which it can be used for things like college tuition, buying a home, or starting a business.

Tax-wise, MAGA accounts are only mildly advantageous. The investments grow tax-deferred (you don’t pay taxes each year on gains), but unlike a 529 college plan, there’s no tax-free withdrawal for education. When the money is taken out for approved uses (say, college or a first home), the earnings are taxed at capital gains rates. If the funds are used for other purposes before age 30, you’d owe income tax plus a 10% penalty on the withdrawal. By age 31, any remaining balance is paid out to the account holder regardless. Aside from the initial $1,000 gift, these accounts operate a lot like a regular brokerage account with some added strings attached.

The hope is that early investment plus the magic of compounding interest will yield a nice little nest egg by adulthood. In fact, if left untouched and never added to, that $1,000 might grow to roughly $5,000 after 18 years. Families with means could contribute regularly and build an even bigger fund (potentially up to ~$100,000 if they maxed out $5k per year). However, that leads to the first big question mark: who is actually able to contribute that kind of money each year?

Will $1,000 Accounts Close the Gap or Widen It?

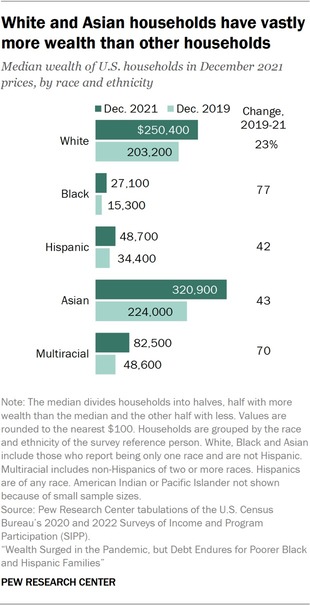

For Black families – who currently hold a fraction of the wealth of white families – a one-size-fits-all $1,000 account is at best a drop in the bucket, and at worst could exacerbate gaps. Today, the median Black household has roughly $27,000 in net worth versus $250,000 for the median white household. That stark inequality is exactly what baby bonds aim to chip away at. MAGA accounts, by contrast, give the same $1,000 to a child raised in a studio apartment as to a child in a mansion, and then essentially say, “Good luck in the stock market.”

Families who can afford to contribute extra (more often white and wealthier) will do so and reap greater gains, while many low-income parents – including a disproportionate share of Black parents – won’t have spare cash to invest after covering rent and groceries. As economist Darrick Hamilton put it, MAGA accounts are a way to “address wealth inequality on the cheap.” They provide no progressive boost to those at the bottom, so they’re likely to be “inequality enhancing,” not reducing.

Even the basic $1,000 isn’t as generous as it sounds. Over 18 years, if untouched, that seed might grow to a few thousand dollars – maybe enough for a semester of community college or a used car. But consider that it now costs over $300,000 to raise a child to age 17 in the U.S. (for a middle-income family). And yet that $1k is locked away until the child turns 18 without giving families the immediate assistance they need now. Contrast that with the expanded Child Tax Credit, which put money into parents’ hands monthly to buy groceries or pay the light bill, or baby bonds, which at least guarantee a substantial asset at adulthood for those who need it most.

A Meaningful Solution or Political Distraction?

It’s hard to ignore the politics surrounding MAGA accounts. The name itself is a not-so-subtle homage as a rallying presidential slogan, and indeed the program would only cover babies born during a specified presidential terms. The same tax bill contains provisions that extend giant tax cuts for corporations and the wealthy. For example, that “One Big Beautiful Bill” also includes massive cuts to programs like Medicaid, which could strip health insurance from 7.6 million Americans (disproportionately impacting Black and low-income communities). One hand gives a dollar while the other takes away a ten – families notice that kind of math.

There are also questions of feasibility and uptake. Will every eligible family actually set up and manage these accounts? And frankly, with the convoluted rules (capital gains taxes here, penalties there), many parents might find the accounts confusing or unattractive. In short, these accounts feel more like a political talking point than a game-changer for family finances.

Investing in Black Families’ Futures: Real Solutions

If our goal is to boost Black family wealth and give every child a fair start, we need bolder, more targeted action. Here are a few steps policymakers should consider:

- Enact Baby Bonds or “American Opportunity Accounts”: Rather than a token one-time deposit, a true baby bonds program would invest continuously in kids from families with little to no wealth. By age 18, every young adult – especially those from low-wealth households – would have a significant asset to seize opportunities (be it college, a business, or home ownership). Research shows this could dramatically close the racial wealth divide for the next generation. States like Connecticut and Washington, D.C. have started baby bonds initiatives, and momentum is building.

- Bring Back (and Enhance) the Expanded Child Tax Credit: Families benefited greatly from the CTC. Food insecurity plummeted, bills got paid, and nearly 3 million children were lifted above the poverty line. Making a fully refundable, expanded CTC permanent would provide ongoing support to families raising kids. It’s essentially a guaranteed income for children – helping cover the everyday costs of parenting so that all kids can thrive.

- Strengthen Family Wealth-Building Tools: We should pair these big ideas with other supports that help families build assets. That could mean first-time homebuyer assistance in historically redlined communities, free or affordable college (so young adults don’t start life under mountains of debt), and incentives for emergency savings to weather crises. While MAGA accounts bank on the stock market, many Black families need relief and investment in more concrete forms: down payments, debt reduction, education and job opportunities. A comprehensive approach to Black wealth-building will span from early childhood (baby bonds, child allowances) to adulthood (fair access to credit, jobs, and asset ownership).

It’s encouraging to see any acknowledgment that building assets for children is important. But in the end, $1,000 MAGA accounts feel like putting a Band-Aid on a gaping wound. Yes, they could help a little – and no family will turn down free money – but they don’t rise to the scale of the challenges Black families face. The racial wealth divide was created by generations of exclusion, discrimination, and disinvestment. Tacking a modest kids’ savings plan onto a tax bill won’t undo that harm, especially not while other policies actively undermine family stability. all families deserve solutions that are bold, equitable, and sustained. In the fight to close the wealth divide, let’s choose substance over slogans every time.